Payments

Integrated Payment Processing

Acumatica Payments dramatically streamlines payment processing -- reducing errors and increasing your operational efficiency. By seamlessly connecting Acumatica to financial and banking networks, our Integrated Payment Processing capabilities enable businesses to conduct secure, compliant, and low-cost credit card, Automated Clearing House (ACH), and Electronic Funds transfers.Key Benefits

-

Optimize Workflows with a Completely Integrated Payments Solution

Eliminate the cost and hassles of integrating and maintaining external or third-party payment systems. Automate your Accounts Receivable processing to reduce back-office workloads, manual entry, and mistakes from re-keying data. Reduce the time you spend managing invoices and payments. With security being so critical to all financial transactions and operations, automated updates to the solution help ensure your payment system is always current and secure.

-

Reduce Payment Processing Fees

Reduce the fees you pay to your merchant account providers. Acumatica Integrated Payment Processing offers reasonable flat rate fees and the flexibility of personalized rates that are attractive for your high-volume scenarios.

-

Get Paid Faster with Modern Electronic Payment Mechanisms

With Acumatica Integrated Payment Processing, instead of using paper checks, your customers can pay with convenient click-to-pay links and manage their invoices with a self-service portal – facilitating faster payments and a better experience for your customers.

-

Boost Sales and Improve Customer Loyalty

A great way to foster relationships, build loyalty and increase sales is through gift cards which offer an attractive and convenient way to reward your customers. Acumatica Payments enables you to manage gift cards and provide your customers with easy access to a portal so they can view their account status at any time and on any device.

Featured Highlights

-

1. Accept All Major Forms of Payment

The new feature enables you to accept credit cards, debit cards, checks, and ACH payments from all major banks and card networks such as Visa, Mastercard, AmEx, and Discover.

-

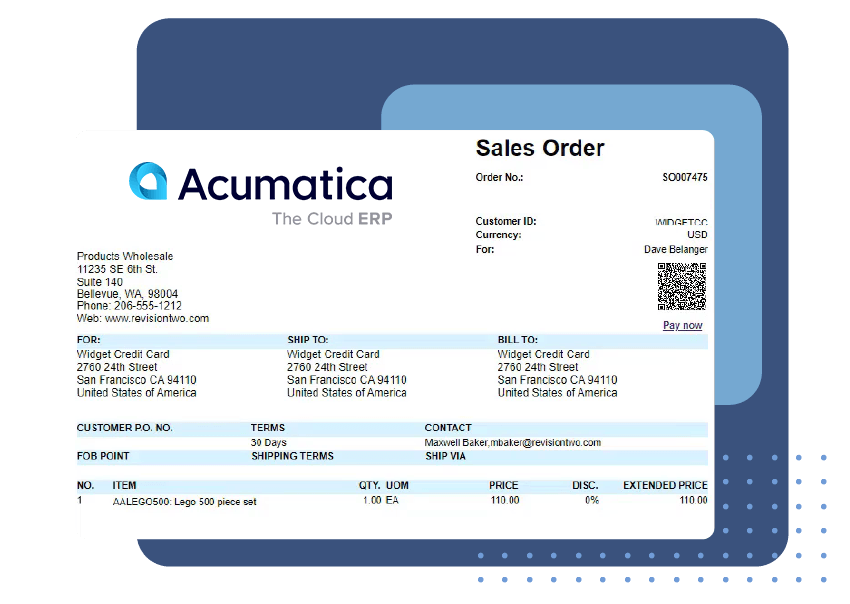

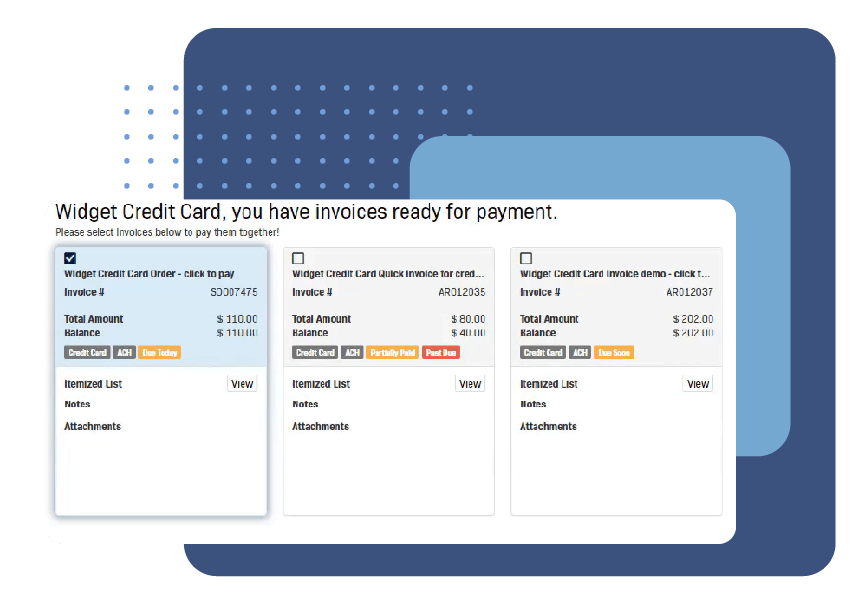

2. Send Payment Links for Easy Payment

Collect money by sending payment links directly from invoices and sales orders. Your customers can simply click a link and enter credit card or ACH details to quickly pay an invoice in full, make a partial payment, or pay multiple invoices at once. The new feature enables you to send links automatically at a specified time or when invoices are available, and quickly respond to customer requests by manually sending links.

-

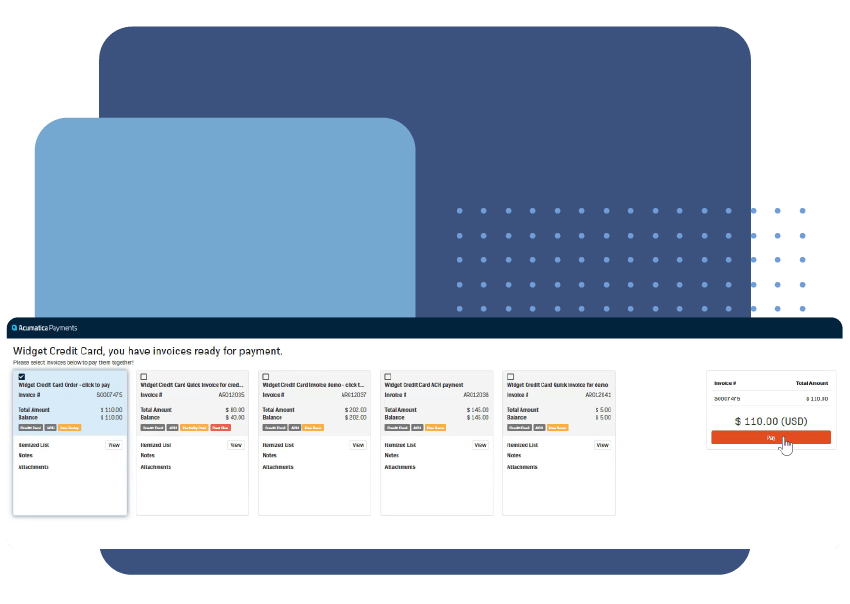

3. Enable Customer Self-Service

Provide a simple and secure way for customers to pay invoices through a self-service portal. Customers securely store their preferred payment method to pay balances on one or more invoices conveniently.

-

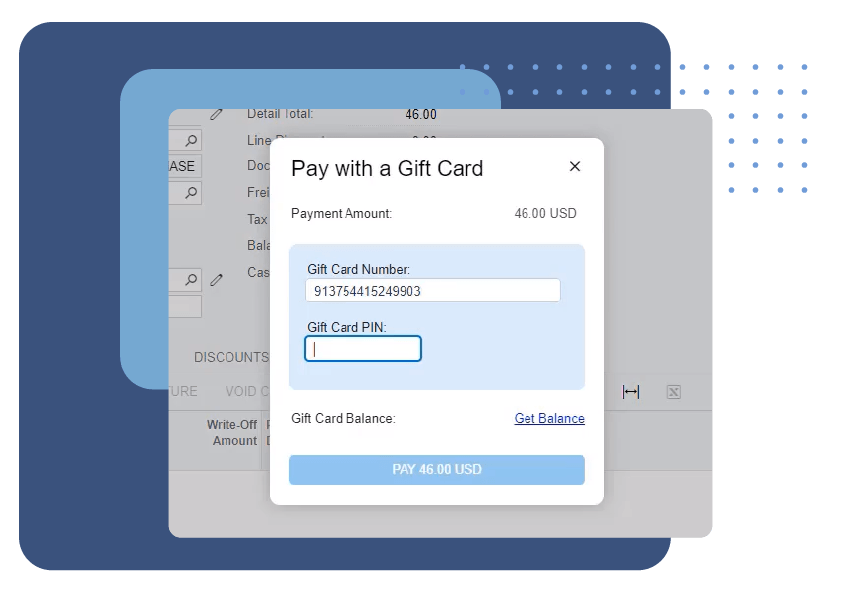

4. Improve Loyalty with Gift Cards

Offer physical or electronic gift cards for holiday gift giving, refunds, or promotions to build loyalty and earn repeat business. Automatically account for expiring gift cards and benefit from unused card balances.

-

5. Accelerate Settlement and Reconciliation

Receive daily bank deposits to improve cash flow. Automatically import electronic files detailing merchant fees and deductions to reduce the time spent reconciling sales with bank deposits.

-

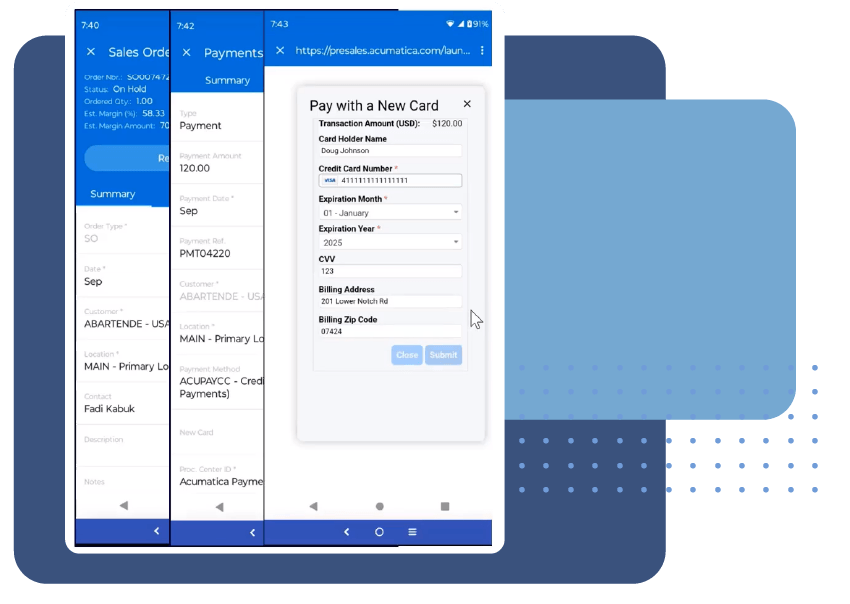

6. Collect Payments on Mobile Phones and Devices

Leverage Acumatica’s mobile application to accept payments anywhere, anytime, using Android and iOS phones. Collect ‘balance due’ during service calls or on-site from a customer’s location.

-

7. Reduce Your Risk with Built-In Security

Securely store credit card information in the payment network with strict limitations on access through secure tokens. Reduce the effort needed to achieve PCI compliance so you minimize processing fees and compliance audits. With information stored in the network, rather than locally, your employees no longer need to handle credit cards, and customers don’t have to email card numbers to you, reducing your customers’ risk of credit card fraud and identity theft.

-

8. Process Recurring Payments

Automatically issue invoices, collect recurring payments, and manage expiring credit cards.

-

9. Manage Partial Shipments and Future Deliveries

Reserve amounts on customer credit cards to ensure payment for scheduled services and future deliveries. Automatically capture the proper amount when services are complete, or goods are shipped. Seamlessly reauthorize transactions with delayed shipments.

-

10. Integrated Card Readers

Use fully integrated, industry-standard credit card terminals to collect money directly from Acumatica screens. Card readers support magnetic stripes, smart cards, and contactless payments and work with Google Pay and Apple Pay. Process payments onsite when a customer physically presents the card to help facilitate retail transactions with less chargeback risk, lower transaction fees, and automatically record payment transactions in Acumatica.